Nos liseuses Vivlio rencontrent actuellement des problèmes de synchronisation. Nous faisons tout notre possible pour résoudre ce problème le plus rapidement possible. Toutes nos excuses pour la gêne occasionnée !

- Retrait gratuit dans votre magasin Club

- 7.000.000 titres dans notre catalogue

- Payer en toute sécurité

- Toujours un magasin près de chez vous

Nos liseuses Vivlio rencontrent actuellement des problèmes de synchronisation. Nous faisons tout notre possible pour résoudre ce problème le plus rapidement possible. Toutes nos excuses pour la gêne occasionnée !

- Retrait gratuit dans votre magasin Club

- 7.000.0000 titres dans notre catalogue

- Payer en toute sécurité

- Toujours un magasin près de chez vous

44,45 €

+ 88 points

Description

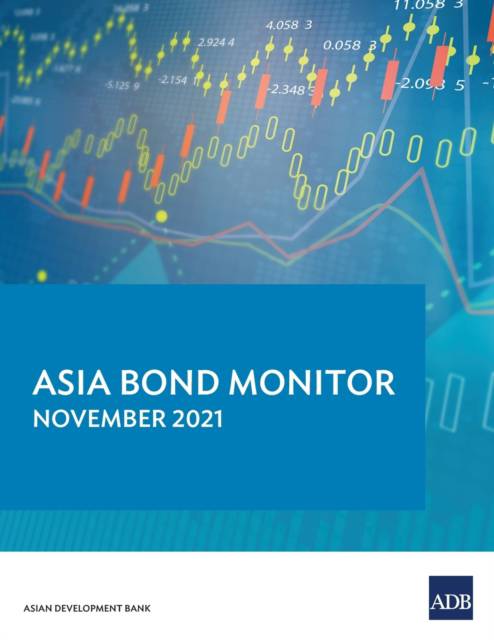

This edition sets out recent developments in East Asian local currency bond markets and discusses the region's economic outlook, the risk of another taper tantrum, and price differences between labeled and unlabeled green bonds. Emerging East Asia's local currency (LCY) bond markets expanded to an aggregate USD21.7 trillion at the end of September 2021, posting growth of 3.4% quarter-on-quarter, up from 2.9% in the previous quarter. LCY bond issuance rose 6.8% quarter-on-quarter to USD2.4 trillion in Q3 2021. Sustainable bond markets in ASEAN+3 also continued to expand to reach a size of USD388.7 billion at the end of September.

Spécifications

Parties prenantes

- Auteur(s) :

- Editeur:

Contenu

- Nombre de pages :

- 102

- Langue:

- Anglais

- Collection :

Caractéristiques

- EAN:

- 9789292691608

- Date de parution :

- 30-05-22

- Format:

- Livre broché

- Format numérique:

- Trade paperback (VS)

- Dimensions :

- 216 mm x 279 mm

- Poids :

- 335 g