- Retrait gratuit dans votre magasin Club

- 7.000.000 titres dans notre catalogue

- Payer en toute sécurité

- Toujours un magasin près de chez vous

- Retrait gratuit dans votre magasin Club

- 7.000.0000 titres dans notre catalogue

- Payer en toute sécurité

- Toujours un magasin près de chez vous

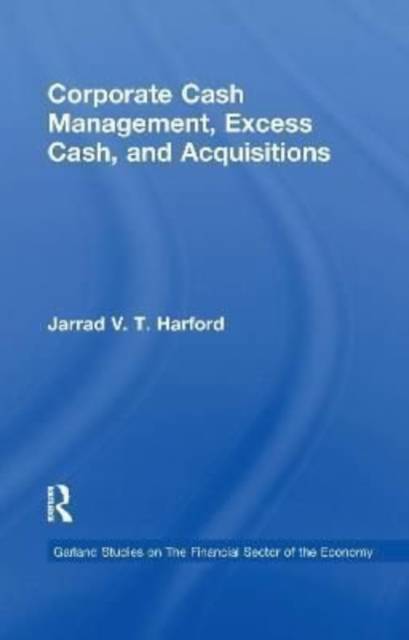

Corporate Cash Management, Excess Cash, and Acquisitions

Jarrad V T Harford

102,45 €

+ 204 points

Format

Description

How much cash should a corporation have and should we worry when they have too much? This question has been hotly debated by manager and investors recently because managers of many of America's leading corporations have chosen to keep the spoils of the long economic expansion rather than return them to investors. As corporate cash coffers burst at the seems, some topping $20 billion, should investors worry about what managers will do with the cash when they finally decide to spend it? This study tackles these and other questions related to corporate cash reserves. After developing a benchmark for the appropriate amount of cash a corporation in a given industry needs to fund its investments and survive an economic downturn, a group of cash-rich corporations are not only more acquisitive than other corporations, but they also tend to make poor acquisition choices, effectively squandering part of their cash reserves. The stock price reaction to acquisition announcements by cash-rich firms is significantly more negative than the reaction to announcements by other firms. The performance of the cash-rich acquirer declines following the acquisition, realizing the expectations of the stock market. Overall, cash-rich firms destroy 7 cents of value for every excess dollar of cash reserves they hold, effectively receiving 93 cents on the dollar! This study documents that not only do managers tend to squander their stockpiles of cash, but also they are able to use this cash to deter any attempt to wrest control of the corporation from their hands. The message for investors and board members to be wary of cash stockpiles is clear.

Spécifications

Parties prenantes

- Auteur(s) :

- Editeur:

Contenu

- Nombre de pages :

- 104

- Langue:

- Anglais

- Collection :

Caractéristiques

- EAN:

- 9781138966789

- Date de parution :

- 21-07-16

- Format:

- Livre broché

- Format numérique:

- Trade paperback (VS)

- Dimensions :

- 140 mm x 216 mm

- Poids :

- 131 g

Les avis

Nous publions uniquement les avis qui respectent les conditions requises. Consultez nos conditions pour les avis.