- Retrait gratuit dans votre magasin Club

- 7.000.000 titres dans notre catalogue

- Payer en toute sécurité

- Toujours un magasin près de chez vous

- Retrait gratuit dans votre magasin Club

- 7.000.000 titres dans notre catalogue

- Payer en toute sécurité

- Toujours un magasin près de chez vous

76,95 €

+ 153 points

Format

Description

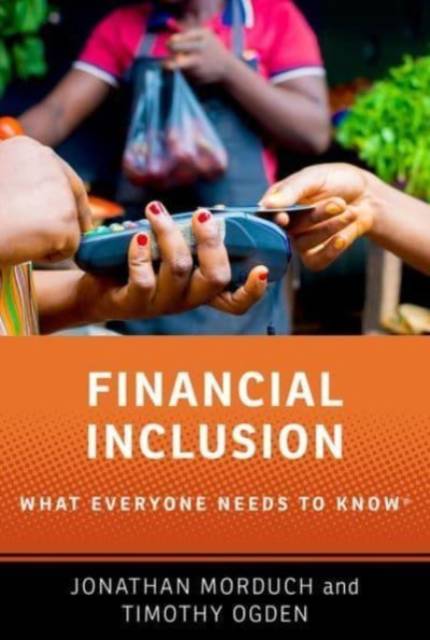

Over 30 percent of the world's adults lack access to basic financial tools---more often women, members of minority groups, and poor families. The abilities to buy what you need, when you need it, to put money aside for the future, and to withstand bad luck without financial ruin seem like basic elements of life in a functioning economy. But life is not that simple for people who lack financial tools. In fact, the tighter the budget, the more you need and benefit from financial services. Financial inclusion--or, put another way, having the tools necessary to take control of one's finances and make progress towards one's goals--is essential to a just and fair society. In Financial Inclusion: What Everyone Needs to Know(R) , prominent experts Jonathan Morduch and Timothy Ogden explain in straightforward language how the lack of financial inclusion reinforces broader inequities in our society. Using their extensive backgrounds in finance, technology, economic change, and inequality, Morduch and Ogden detail efforts to guarantee that all people, rich and poor, have access to quality financial services and the ability to make prudent financial choices. Framed by the simple concept of equal access, this book explains the mechanisms of one of the most contentious and misunderstood parts of modern economics by answering a few core questions: What is financial inclusion? Why does it matter? How does it work? When doesn't it work? What are the risks? How can more people be included?

Spécifications

Parties prenantes

- Auteur(s) :

- Editeur:

Contenu

- Nombre de pages :

- 208

- Langue:

- Anglais

- Collection :

Caractéristiques

- EAN:

- 9780190249977

- Date de parution :

- 01-11-24

- Format:

- Livre relié

- Format numérique:

- Genaaid

- Dimensions :

- 3 mm x 3 mm

- Poids :

- 3 g