- Retrait gratuit dans votre magasin Club

- 7.000.000 titres dans notre catalogue

- Payer en toute sécurité

- Toujours un magasin près de chez vous

- Retrait gratuit dans votre magasin Club

- 7.000.000 titres dans notre catalogue

- Payer en toute sécurité

- Toujours un magasin près de chez vous

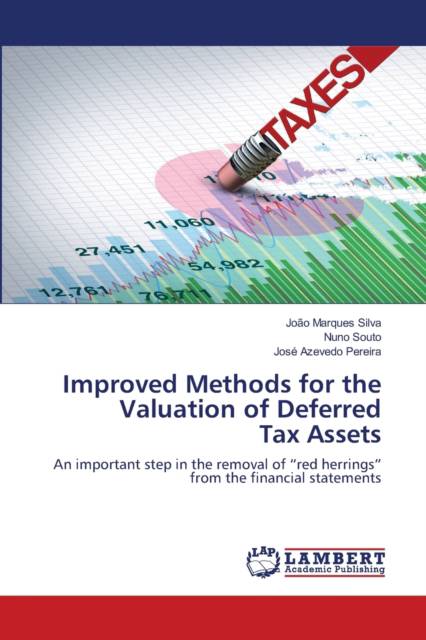

Improved Methods for the Valuation of Deferred Tax Assets

João Marques Silva, Nuno Souto, José Azevedo Pereira

Livre broché | Anglais

47,95 €

+ 95 points

Description

Deferred tax asset (DTA) is a tax/accounting concept that refers to an asset that may be used to reduce future tax liabilities of the holder. In the banking sector, it usually refers to situations where a bank has either overpaid taxes, paid taxes in advance or has carry-over of losses. In fact, accounting and tax losses may be used to shield future profits from taxation, through tax loss carry-forwards. DTAs are contingent claims, whose underlying assets are banks future profits. The correct approach to value such rights implies necessarily, the use of a contingent claim valuation framework. One common practice consists in valuing DTAs as though they would be used at 100% without even discounting for the time value of money. Another common procedure consists in considering a subjective "valuation allowance", valuing the deferred tax asset as a certain percentage of the corresponding maximum value, according to future expectations on the company's financial performance. The purpose of this book is exactly to propose a precise and conceptually sound mathematical approach to value DTAs, considering future projections of earnings and rates, alongside the DTA's legal time limit.

Spécifications

Parties prenantes

- Auteur(s) :

- Editeur:

Contenu

- Nombre de pages :

- 52

- Langue:

- Anglais

Caractéristiques

- EAN:

- 9786203410259

- Date de parution :

- 10-02-21

- Format:

- Livre broché

- Format numérique:

- Trade paperback (VS)

- Dimensions :

- 152 mm x 229 mm

- Poids :

- 90 g