- Retrait gratuit dans votre magasin Club

- 7.000.000 titres dans notre catalogue

- Payer en toute sécurité

- Toujours un magasin près de chez vous

- Retrait gratuit dans votre magasin Club

- 7.000.0000 titres dans notre catalogue

- Payer en toute sécurité

- Toujours un magasin près de chez vous

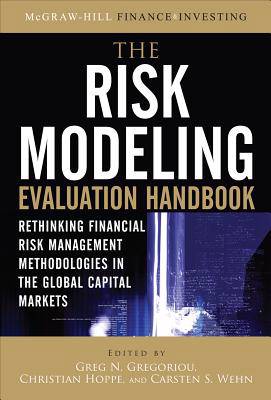

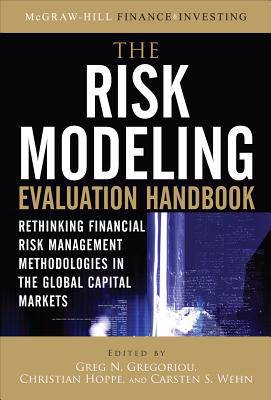

The Risk Modeling Evaluation Handbook: Rethinking Financial Risk Management Methodologies in the Global Capital Markets

Greg Gregoriou, Christian Hoppe, Carsten WehnDescription

The first in-depth analysis of inherent deficiencies in present practices

"A book like this helps reduce the chance of a future breakdown in risk management."

Professor Campbell R. Harvey, the Fuqua School of Business, Duke University

"A very timely and extremely useful guide to the subtle and often difficult issues involved in model risk--a subject which is only now gaining the prominence it should always have had."

Professor Kevin Dowd, Nottingham University Business School, the University of Nottingham

"This book collects authoritative papers on a timely and important topic . . . and should lead to many new insights."

Professor Philip Hans Franses, Erasmus School of Economics, Erasmus University

"Inadequate valuation and risk management models have played their part in triggering the recent economic turmoil felt around the world. This timely book, written by experts in the field of model risk, will surely help risk managers and financial engineers measure and manage risk effectively."

Dr. Fabrice Douglas Rouah, Vice President, State Street Corporation

"This invaluable handbook has been edited by experts . . . and should prove to be of great value to investment finance and credit risk modelers in a wide range of disciplines related to portfolio risk, risk modeling in finance, international money and finance, country risk, and macroeconomics."

Professor Michael McAleer, Erasmus School of Economics, Erasmus University

About the Book:

If we have learned anything from the global financial collapse of 2008, it is this: the mathematical risk models currently used by financial institutions are no longer adequate quantitative measures of risk exposure.

In The Risk Modeling Evaluation Handbook, an international team of 48 experts evaluates the problematic risk-modeling methods used by large financial institutions and breaks down how these models contributed to the decline of the global capital markets. Their conclusions enable you to identify the shortcomings of the most widely used risk models and create sophisticated strategies for properly implementing these models into your investing portfolio.

Chapters include:

- Model Risk: Lessons from Past Catastrophes (Scott Mixon)

- Effect of Benchmark Misspecification on Riskadjusted Performance Measures (Laurent Bodson and George Hübner)

- Carry Trade Strategies and the Information Content of Credit Default Swaps (Raphael W. Lam and Marco Rossi)

- Concepts to Validate Valuation Models (Peter Whitehead)

- Beyond VaR: Expected Shortfall and Other Coherent Risk Measures (Andreas Krause)

- Model Risk in Credit Portfolio Modeling (Matthias Gehrke and Jeffrey Heidemann)

- Asset Allocation under Model Risk (Pauline M. Barrieu and Sandrine Tobolem)

This dream team of the masters of risk modeling provides expansive explanations of the types of model risk that appear in risk measurement, risk management, and pricing, as well as market-tested techniques for mitigating risk in loan, equity, and derivative portfolios.

The Risk Modeling Evaluation Handbook is the go-to guide for improving or adjusting your approach to modeling financial risk.

Spécifications

Parties prenantes

- Auteur(s) :

- Editeur:

Contenu

- Nombre de pages :

- 528

- Langue:

- Anglais

- Collection :

Caractéristiques

- EAN:

- 9780071663700

- Date de parution :

- 01-02-10

- Format:

- Livre relié

- Format numérique:

- Genaaid

- Dimensions :

- 176 mm x 239 mm

- Poids :

- 857 g

Les avis

Nous publions uniquement les avis qui respectent les conditions requises. Consultez nos conditions pour les avis.