En raison d'une grêve chez bpost, votre commande pourrait être retardée. Vous avez besoin d’un livre rapidement ? Nos magasins vous accueillent à bras ouverts !

- Retrait gratuit dans votre magasin Club

- 7.000.000 titres dans notre catalogue

- Payer en toute sécurité

- Toujours un magasin près de chez vous

En raison de la grêve chez bpost, votre commande pourrait être retardée. Vous avez besoin d’un livre rapidement ? Nos magasins vous accueillent à bras ouverts !

- Retrait gratuit dans votre magasin Club

- 7.000.0000 titres dans notre catalogue

- Payer en toute sécurité

- Toujours un magasin près de chez vous

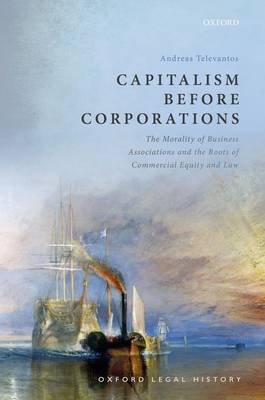

Capitalism Before Corporations

The Morality of Business Associations and the Roots of Commercial Equity and Law

Andreas Televantos

209,45 €

+ 418 points

Description

To what extent did English law facilitate trade before the advent of general incorporation and modern securities law? This is the question at the heart of Capitalism before Corporations. It examines the extent to which legal institutions of the Regency period, especially Lord Eldon's Chancellorship, were sympathetic to the needs of merchants and willing to accommodate their changing practices and demands within established legal doctrinal frameworks and contemporary political economic thought. In so doing, this book probes at the heart of modern debates about equity, trusts, insolvency, and the justifiability of corporate privileges. Corporations are an integral part of modern life. We bank with corporations, we usually buy our groceries from them, and they provide us with most news and media. We take it for granted too that most large-scale business, and even much small-scale business, is carried out by corporations. Things were not always so. Televantos considers the Bubble Act of 1720, which criminalised the forming of corporations without a Royal Charter or Act of Parliament, its repeal in 1825, and the subsequent impact. Much of the modernisation of Britain's industry therefore took place before general incorporation was allowed. Unaided by statute, traders had to create business organisations using the basic building blocks of private law: trusts, partnership, and agency.

Spécifications

Parties prenantes

- Auteur(s) :

- Editeur:

Contenu

- Nombre de pages :

- 226

- Langue:

- Anglais

- Collection :

Caractéristiques

- EAN:

- 9780198870340

- Date de parution :

- 03-02-21

- Format:

- Livre relié

- Format numérique:

- Genaaid

- Dimensions :

- 155 mm x 236 mm

- Poids :

- 748 g

Les avis

Nous publions uniquement les avis qui respectent les conditions requises. Consultez nos conditions pour les avis.