- Retrait gratuit dans votre magasin Club

- 7.000.000 titres dans notre catalogue

- Payer en toute sécurité

- Toujours un magasin près de chez vous

- Retrait gratuit dans votre magasin Club

- 7.000.0000 titres dans notre catalogue

- Payer en toute sécurité

- Toujours un magasin près de chez vous

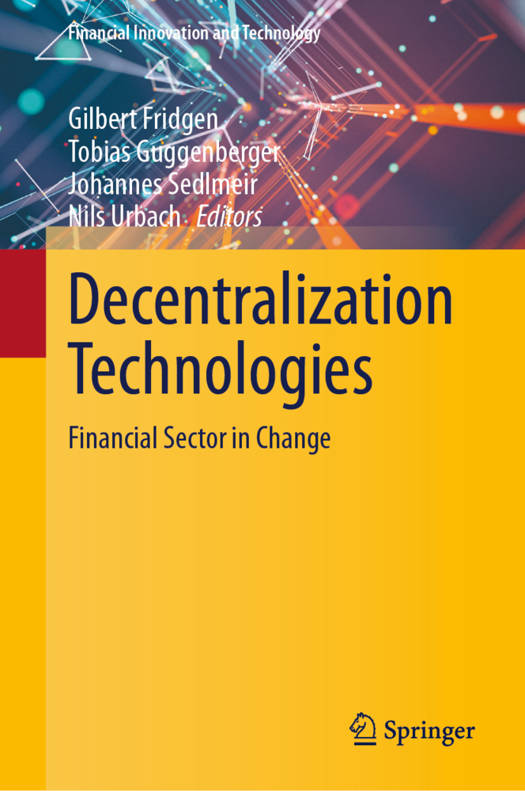

Decentralization Technologies

Financial Sector in Change

Description

This book connects decentralization technologies with the world of finance and financial services. Increasingly, the financial sector is data-driven, with tensions arising between technical innovations and regulators' and consumers' expectations. Fundamentally, financial markets are competitive data markets. The authors of this edited book first identify where changes in the regulatory and business regime give rise to novel requirements and needs for these data markets. Next, the authors introduce three key decentralization technologies -decentralized digital identities, distributed ledger technologies, and federated learning. They discuss privacy-enhancing technologies such as zero-knowledge proofs and illustrate the demands of practical applications. The authors further provide explicit application examples to illustrate where and how these decentralization technologies allow to reflect business, customer, and regulatory requirements amid competitive markets. The volume concludes with an outlook on governance and the sustainability implications of decentralization.

Spécifications

Parties prenantes

- Editeur:

Contenu

- Nombre de pages :

- 263

- Langue:

- Anglais

- Collection :

Caractéristiques

- EAN:

- 9783031660467

- Date de parution :

- 11-12-24

- Format:

- Livre relié

- Format numérique:

- Genaaid

- Dimensions :

- 156 mm x 234 mm

- Poids :

- 589 g

Les avis

Nous publions uniquement les avis qui respectent les conditions requises. Consultez nos conditions pour les avis.