En raison d'une grêve chez bpost, votre commande pourrait être retardée. Vous avez besoin d’un livre rapidement ? Nos magasins vous accueillent à bras ouverts !

- Retrait gratuit dans votre magasin Club

- 7.000.000 titres dans notre catalogue

- Payer en toute sécurité

- Toujours un magasin près de chez vous

En raison de la grêve chez bpost, votre commande pourrait être retardée. Vous avez besoin d’un livre rapidement ? Nos magasins vous accueillent à bras ouverts !

- Retrait gratuit dans votre magasin Club

- 7.000.0000 titres dans notre catalogue

- Payer en toute sécurité

- Toujours un magasin près de chez vous

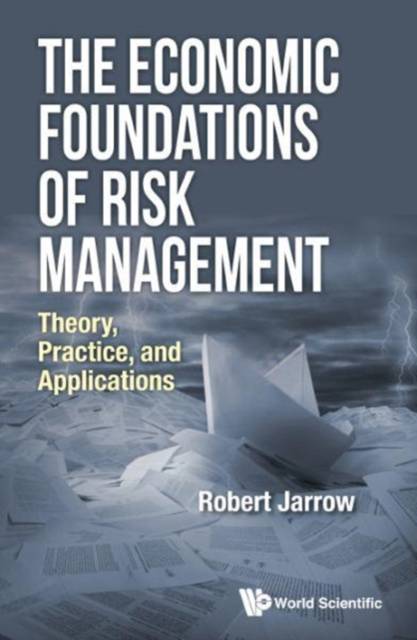

Economic Foundations of Risk Management, The: Theory, Practice, and Applications

Robert A Jarrow

Livre relié | Anglais

114,45 €

+ 228 points

Format

Description

'The book is an ideal complement to existing monographs on financial risk management. The reader will benefit from a standard background in no-arbitrage pricing. A tour of risk types and risk management principles is presented in a terse, no-fuss manner. Plenty of pointers to additional literature are given, allowing the interested reader to go deeper into any of the topics presented.'Newsletter of the Bachelier Finance Society The Economic Foundations of Risk Management presents the theory, the practice, and applies this knowledge to provide a forensic analysis of some well-known risk management failures. By doing so, this book introduces a unified framework for understanding how to manage the risk of an individual's or corporation's or financial institution's assets and liabilities. The book is divided into five parts. The first part studies the markets and the assets and liabilities that trade therein. Markets are differentiated based on whether they are competitive or not, frictionless or not (and the type of friction), and actively traded or not. Assets are divided into two types: primary assets and financial derivatives. The second part studies models for determining the risks of the traded assets. Models provided include the Black-Scholes-Merton, the Heath-Jarrow-Morton, and the reduced form model for credit risk. Liquidity risk, operational risk, and trading constraint models are also contained therein. The third part studies the conceptual solution to an individual's, firm's, and bank's risk management problem. This formulation involves solving a complex dynamic programming problem that cannot be applied in practice. Consequently, Part IV investigates how risk management is actually done in practice via the use of diversification, static hedging, and dynamic hedging. Finally, Part V applies these collective insights to six case studies, which are famous risk management failures. These are Penn Square Bank, Metallgesellschaft, Orange County, Barings Bank, Long Term Capital Management, and Washington Mutual. The credit crisis is also discussed to understand how risk management failed for many institutions and why.

Spécifications

Parties prenantes

- Auteur(s) :

- Editeur:

Contenu

- Nombre de pages :

- 208

- Langue:

- Anglais

Caractéristiques

- EAN:

- 9789813147515

- Date de parution :

- 03-01-17

- Format:

- Livre relié

- Format numérique:

- Genaaid

- Dimensions :

- 155 mm x 231 mm

- Poids :

- 498 g

Les avis

Nous publions uniquement les avis qui respectent les conditions requises. Consultez nos conditions pour les avis.