En raison d'une grêve chez bpost, votre commande pourrait être retardée. Vous avez besoin d’un livre rapidement ? Nos magasins vous accueillent à bras ouverts !

- Retrait gratuit dans votre magasin Club

- 7.000.000 titres dans notre catalogue

- Payer en toute sécurité

- Toujours un magasin près de chez vous

En raison de la grêve chez bpost, votre commande pourrait être retardée. Vous avez besoin d’un livre rapidement ? Nos magasins vous accueillent à bras ouverts !

- Retrait gratuit dans votre magasin Club

- 7.000.0000 titres dans notre catalogue

- Payer en toute sécurité

- Toujours un magasin près de chez vous

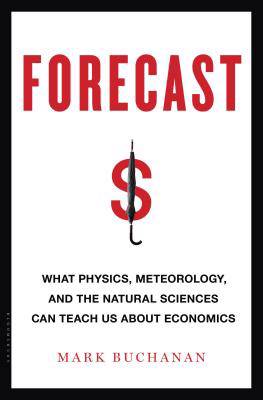

Forecast

What Physics, Meteorology, and the Natural Sciences Can Teach Us about Economics

Mark Buchanan

Livre relié | Anglais

26,95 €

+ 53 points

Format

Description

Picture an early scene from The Wizard of Oz: Dorothy hurries home as a tornado gathers in what was once a clear Kansas sky. Hurriedly, she seeks shelter in the storm cellar under the house, but, finding it locked, takes cover in her bedroom. We all know how that works out for her.

Many investors these days are a bit like Dorothy, putting their faith in something as solid and trustworthy as a house (or, say, real estate). But market disruptions--storms--seem to arrive without warning, leaving us little time to react. Why are we so often blindsided by these things, left outdoors with nothing but our little dogs? More to the point: how did Kansas go from blue skies to tornadoes in such a short time? In this deeply researched and piercingly intelligent book, physicist Mark Buchanan shows how a simple feedback loop can lead to major consequences, the kind predictable by mathematical models but hard for most people to anticipate. From his unique perspective, Buchanan argues that our basic assumptions about economic markets--that they are for the most part stable, with occasional interruptions--are simply wrong. Markets really act more like the weather: a brief heat wave can become a massive storm in a matter of a few days, or even hours. The Physics of Finance reimagines the basics of how economics, with consequences that affect everyone.Spécifications

Parties prenantes

- Auteur(s) :

- Editeur:

Contenu

- Nombre de pages :

- 272

- Langue:

- Anglais

Caractéristiques

- EAN:

- 9781608198511

- Date de parution :

- 26-03-13

- Format:

- Livre relié

- Format numérique:

- Genaaid

- Dimensions :

- 164 mm x 241 mm

- Poids :

- 521 g

Les avis

Nous publions uniquement les avis qui respectent les conditions requises. Consultez nos conditions pour les avis.