- Retrait gratuit dans votre magasin Club

- 7.000.000 titres dans notre catalogue

- Payer en toute sécurité

- Toujours un magasin près de chez vous

- Retrait gratuit dans votre magasin Club

- 7.000.0000 titres dans notre catalogue

- Payer en toute sécurité

- Toujours un magasin près de chez vous

Description

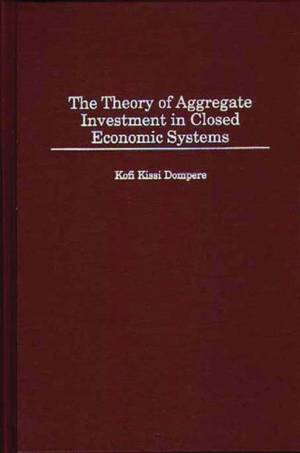

Although economic theory has increased our understanding of some economic problems, it has rendered others, including the problem of capital accumulation, growth, and development, more difficult to understand. Focusing on capitalist economic systems, this book develops a theoretical approach to the study of aggregate capital dynamics. The theory is developed within the Keynesian framework of aggregate thinking and builds on the work of such Cambridge economists as Robinson, Kaldor, and Pasinetti. The approach helps to resolve some theoretical difficulties within the Keynesian framework for studying aggregate investment behavior. Dompere also provides a criticism of the neoclassical investment theory and the general neoclassical theoretical framework for studying aggregate capital accumulation, investment, and growth.

Reexamining some questions on investment that earlier theorists have tried to answer, this study develops some of the basic ideas of Keynes, Robinson, Kaldor, and Pasinetti into a general theoretical system that allows an optimal aggregate capital and investment to be determined for a given information set.Spécifications

Parties prenantes

- Auteur(s) :

- Editeur:

Contenu

- Nombre de pages :

- 224

- Langue:

- Anglais

- Collection :

Caractéristiques

- EAN:

- 9780313307966

- Date de parution :

- 30-11-99

- Format:

- Livre relié

- Format numérique:

- Genaaid

- Dimensions :

- 163 mm x 243 mm

- Poids :

- 517 g

Les avis

Nous publions uniquement les avis qui respectent les conditions requises. Consultez nos conditions pour les avis.