- Retrait gratuit dans votre magasin Club

- 7.000.000 titres dans notre catalogue

- Payer en toute sécurité

- Toujours un magasin près de chez vous

- Retrait gratuit dans votre magasin Club

- 7.000.0000 titres dans notre catalogue

- Payer en toute sécurité

- Toujours un magasin près de chez vous

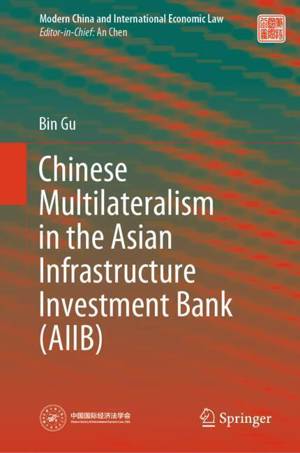

Chinese Multilateralism in the Asian Infrastructure Investment Bank (Aiib)

Bin GuDescription

This book reflects the latest legal development of the Asian Infrastructure Investment Bank (AIIB), and makes direct and positive responses--it uses first-hand, authoritative information and makes insightful and persuasive analyses in addressing those concerns.

In particular, this book provides nuanced analysis of the following topics:

-- capital allocation of the AIIB, in comparison with those of Bretton Woods institutions;

-- dynamic relationship between the shareholder board and management, a central topic of corporate governance for the AIIB and other MDBs;

-- AIIB's environmental and social safeguards, including its frontier ESG portfolio investments, in comparison with the World Bank standards;-- highly debatable issues relating to the interaction between AIIB, Belt and Road, and MCDF;

-- comparative study of state-owned enterprises in the laws of AIIB, WTO, ICSID, etc..

This book targets academics, students, policymakers, and businesscircles who are interested in AIIB, given the bank's growing importance in the context of global economic governance reforms. First, the book is a must for those who are keen to gain insight into the AIIB. Ten years have passed since the debut of the idea of AIIB in 2013, and the topic has never retreated from the debate of the international community--a major concern is whether a China-led multilateral development bank (MDB) remains to be politically neutral, or professional, and can live up to high standards.

Spécifications

Parties prenantes

- Auteur(s) :

- Editeur:

Contenu

- Nombre de pages :

- 195

- Langue:

- Anglais

- Collection :

Caractéristiques

- EAN:

- 9789819712182

- Date de parution :

- 15-05-24

- Format:

- Livre relié

- Format numérique:

- Genaaid

- Dimensions :

- 156 mm x 234 mm

- Poids :

- 462 g

Les avis

Nous publions uniquement les avis qui respectent les conditions requises. Consultez nos conditions pour les avis.