- Retrait gratuit dans votre magasin Club

- 7.000.000 titres dans notre catalogue

- Payer en toute sécurité

- Toujours un magasin près de chez vous

- Retrait gratuit dans votre magasin Club

- 7.000.0000 titres dans notre catalogue

- Payer en toute sécurité

- Toujours un magasin près de chez vous

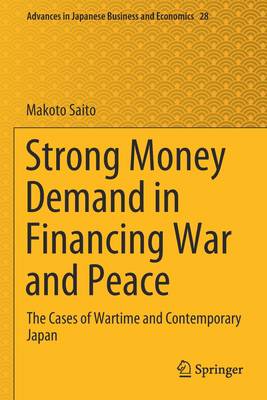

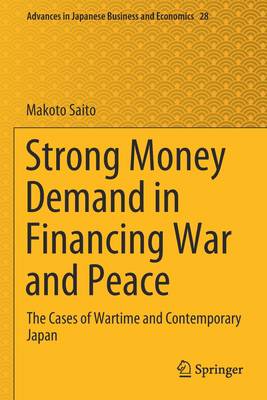

Strong Money Demand in Financing War and Peace

The Cases of Wartime and Contemporary Japan

Makoto SaitoDescription

This book theoretically and empirically investigates the emergence of strong money demand in wartime Japan (1937-1945), its disappearance after the end of the war (1945-1949), and the reemergence of strong money demand in contemporary Japan (from 1995 to the present) in terms of the effects on fiscal activities and the price level. An augmented fiscal/monetary theory of the price level is constructed from a close examination of the strong money demand present in these periods. Then, profoundly puzzling phenomena such as mild deflation despite monetary expansion, low long-term interest rates despite fiscal unsustainability, and weak aggregate demand despite near-zero rates of interest, all of which are actually being observed in contemporary Japan, can now be interpreted in line with the above augmented theory. In the present, strong money demand at near-zero rates endows the Japanese government with maximum fiscal flexibility. However, if it disappeared for some reason, prices would surge to the quantity theory of money level, and fiscal sustainability would have to be restored. In the future, alternative currency units issued by private banks might carry out a purge of such strong demand for the yen.

Spécifications

Parties prenantes

- Auteur(s) :

- Editeur:

Contenu

- Nombre de pages :

- 204

- Langue:

- Anglais

- Collection :

- Tome:

- n° 28

Caractéristiques

- EAN:

- 9789811624483

- Date de parution :

- 18-06-22

- Format:

- Livre broché

- Format numérique:

- Trade paperback (VS)

- Dimensions :

- 156 mm x 234 mm

- Poids :

- 326 g

Les avis

Nous publions uniquement les avis qui respectent les conditions requises. Consultez nos conditions pour les avis.